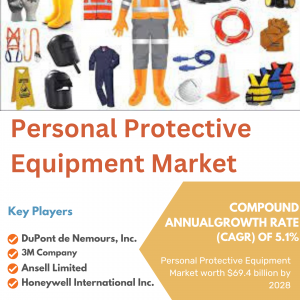

Personal Protective Equipment Market size was USD 54.0 billion in 2023 to USD 69.4 billion by 2028, at a CAGR of 5.1% from 2023 to 2028, according to a new report by MarketsandMarkets™. This growth is primarily triggered by the rising awareness about workplace safety, stringent regulations in developed countries and outbreak of Covid-19 pandemic. According to OSHA, workplace injuries have witnessed an increase each year in the US. OSHA reported that workplace eye injury costs an estimated USD 300 million a year in medical treatment, lost productivity, and worker compensation. Data from the U.S. Bureau of Labor Statistics (BLS) also supports the fact, stating that a majority of the injured workers were not wearing PPE at the time of the accident. A number of losses, both direct and hidden costs, occur when a workplace accident occurs. Direct costs are realized at the time of accidents whereas hidden costs are realized post-accidents. As a result of increasing accidents and injuries at the workplace, the importance of work safety is rising.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=132681971

Browse in-depth TOC on “Personal Protective Equipment Market”

218 – Tables

47 – Figures

250 – Pages

Hand & Arm is estimated to be the largest type of personal protective equipment market in 2021.

Hand & arm protection includes three subcategories, namely, disposable gloves, reusable gloves, and others (wrist cuffs & armlets, elbow protectors, mitts, and barrier creams). Hand & arm protection is not only used to protect an individual from hazards or injuries at workplaces, but also to prevent the spread of COVID-19. The disposable gloves subsegment led the hand & arm protection equipment market in 2020 due to the increased demand from the healthcare industry. Disposable gloves are for single use and need to be disposed immediately, this ensures hygiene and prevention of contamination. The increasing number of hand cuts, abrasions, thermal burns, bruises, punctures, and arm injuries in daily activities is expected to fuel the market for hand & arm protection equipment during the forecast period.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=132681971

Healthcare is estimated to be the largest end-use industry of personal protective equipment market in 2021

The rising prevalence of COVID-19 was a key contributor to the increase in the use of personal protective equipment globally. Factors such as the increasing demand for hospital beds and ICUs in countries with increasing incidences of COVID-19 and an increasing number of temporary hospitals are driving the demand for personal protective equipment in hospitals while treating patients. Infrastructural expansion was evident on a global scale as governments made efforts to combat the virus and care for an increasing number of patients. All these factors increased the demand for personal protective equipment in 2020 and 2021 from the healthcare industry. However, demand is expected to decrease in the coming years, as the spread of COVID-19 is decreasing in most countries and governments too have lifted the mandates for the use of face masks in public places.

Asia Pacific is projected to be the fastest growing market for personal protective equipment during the forecast period.

The Asia Pacific offers the highest opportunities for personal protective equipment as it is one of the highest affected regions due to COVID-19. Growing awareness of personnel and workplace safety are also fueling the market demand in this region. The rising industrial developments, economic growth, and favorable business practices in the Asia Pacific are driving the demand for personal protective equipment.

Personal Protective Equipment Market Key Players

The key market players profiled in the report include Honeywell International Inc. (US), DuPont De Nemours, Inc. (US), 3M Company (US), Lakeland Industries, Inc. (US), Alpha Pro Tech, Ltd. (Canada), Sioen Industries NV (Belgium), Radians Inc. (US), Kimberly-Clark Corporation (US), Ansell Ltd. (Australia), and MSA Safety Inc. (US), among others.

Inquire Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=132681971

Honeywell International Inc.

Honeywell International Inc. is a multinational company known for its diverse range of products and services, including a strong presence in the personal protective equipment (PPE) market. With a more than a century-long history, the company has gained a reputation for innovation and excellence in the manufacture of PPE goods. Honeywell International Inc. focus to individual safety and well-being is obvious in its comprehensive range of PPE options, which includes ranging from high-quality safety goggles, respiratory protection, and gloves to innovative hearing protection and headgear. For instance, in February 2022, Honeywell International Inc. announced a partnership with AstraZeneca to develop new-generation respiratory inhalers that use near-zero global warming potential propellants to treat chronic obstructive pulmonary disease (COPD) and asthma.