1) Overview of Spices Board Registration

a) The Spices Board is the regulatory body comes under Ministry of Commerce & Industry that promotes Indian spices in the global market.

b) The Spices Board was a bridge between Indian exporters and foreign importers for spices related products.

c) The main responsible for Spices Board council was developing and promoting the export industry in India especially for spices related products.

d) It is the one type of export promotion councils in India. Curre... more1) Overview of Spices Board Registration

a) The Spices Board is the regulatory body comes under Ministry of Commerce & Industry that promotes Indian spices in the global market.

b) The Spices Board was a bridge between Indian exporters and foreign importers for spices related products.

c) The main responsible for Spices Board council was developing and promoting the export industry in India especially for spices related products.

d) It is the one type of export promotion councils in India. Currently there are 37 export promotion councils available in India.

e) Spices Board license was provided by spices board council, it was valid for 3 years only. The person requires to apply for spices board renewal 1 month before the expiry of the day.

2) Functions of Spices Board Council

a) It provides the financial assistance of development of export industries relating to the scheduled products.

b) It supervises the standards and specifications for the spices related scheduled products.

c) Carrying out inspection of spices, spices related products and storage premises for ensuring the quality of such products.

d) Improving the package, development and marketing of the scheduled products outside India.

e) Conduct the proper training program to the exporters and also organize the B2B meeting for the buyers and sellers.

3) Benefits of Spices Board Registration

a) If we can do any spices related export business then we must register in the member of spices board council.

b) Spices board registered members can participate in various training programs that was organized by spices board council for improve their export business.

c) There are various financial schemes available for exporters to develop their export business.

d) They provide the proper guidelines to exporters about the various scheduled products and countries for export business.

For more: https://registrationshops.in/spices-board-registration

#spicesboard #spices_board_registration #spices #spices_board_of_india #business #company #madurai #india

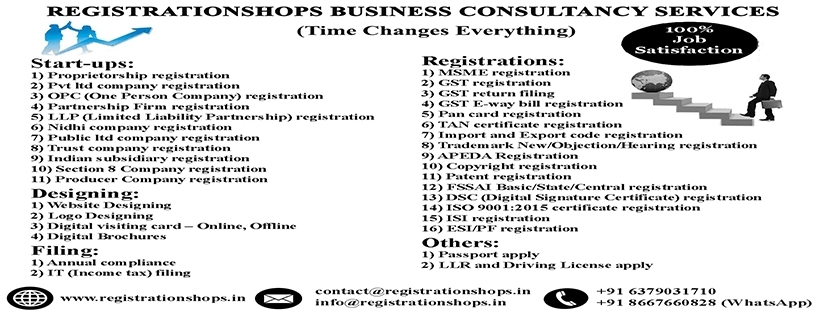

We can consider the following things before we can start the business in India

1) Business activities

2) Investment amount

3) Number of persons to start the business

4) Place of business

Based on above things we can categorized the companies in following ways

1) Proprietorship Firm registration

2) Partnership Firm registration

3) LLP (Limited Liability Partnership) registration

4) OPC (One Person Company) registration

5) Private Limited Company registration

6) Public Limited Company ... moreWe can consider the following things before we can start the business in India

1) Business activities

2) Investment amount

3) Number of persons to start the business

4) Place of business

Based on above things we can categorized the companies in following ways

1) Proprietorship Firm registration

2) Partnership Firm registration

3) LLP (Limited Liability Partnership) registration

4) OPC (One Person Company) registration

5) Private Limited Company registration

6) Public Limited Company registration

7) Trust Company registration

8) Nidhi Company registration

9) Indian Subsidiary registration

10) Section 8 Company registration

11) Producer Company registration

1.a) Overview of Proprietorship Firm Registration

a) Proprietorship firm registration is a Single person firm registration. It is also called as sole proprietorship firm registration.

b) Most of the people can choose proprietorship firm in India because it is the easiest way to start the business as compare as other company registration.

c) A Proprietorship firm have any name but it does not have already registered trademark name.

d) A Proprietorship firm has less than Rs.2.5 lakhs of income per annum is not required to pay any income tax.

e) Sole Proprietorship firm registration was mainly register to open a bank account in the name of their company name.

f) In a proprietorship firm, the owner of the person was called Proprietor. The proprietor manages the entire company and also he/she is the responsible of each and every transaction made in his/her company.

g) Proprietorship firm is not separate legal entity as compared as other company registration.

1.b) Proprietorship Firm Registration types

Sole Proprietorship Firm registration can be done in 5 ways in India

a) Register under MSME/Udyam

b) Register under GST

c) Register under FSSAI

d) Register under Shop and Establishment Act License

e) Register under Trade License

1.c) Advantages of Proprietorship firm

a) Proprietorship firm can handle only single person who operates and manages the whole business, so 100% of the profits belong to the proprietor.

b) It will take very less time to register as compared to other company registration.

c) The income tax rate for sole proprietorship firm is the same as that of the income tax rate of individuals.

d) As comparison to other business form, cost of registering proprietorship firm is very low.

e) The proprietor does not have to consult anyone for taking his decision. So this helps him to make quick decisions.

f) It is the life time certificate when you register under MSME/Udyam or GST. You can’t renew that certificate.

For more: https://registrationshops.in/proprietorship-firm/

2.a) Overview of Partnership Firm Registration

a) Partnership registration is a two or more persons decide to set up the business and form a relationship to share the profits of the business which is governed and regulated by agreement formed between them.

b) It is one of the most popular business structures in India with the legal agreement between the partners.

c) Partnership firms are governed by the Indian Partnership Act, 1932. Rights and duties of partners are governed by this Act.

d) The partnership agreement is also called as partnership deed, which contains names of the partners and their addresses, the partnership name, the date of commencement of operation of the firm, any capital invested by each partner and profit-sharing matrix, rules and regulations to be followed for intake of partners or removal.

e) A partnership firm must have minimum two partners, we can include up to 10 partners in the banking business, while those engaged in any other business can include up to 50 partners.

2.b) Partnership Firm Registration types

Partnership firm registration can be done in 2 ways in India

a) Notarized registration

b) Register in sub registrar office

2.c) Benefits of Partnership Firm registration

a) As comparison to other business form, cost of registering partnership firm is very low.

b) Forming a partnership firm is easy and less complicated as compared to companies.

c) Any name can be chosen for a Partnership firm as long as it does not infringe on any registered trademark.

d) If any dispute arises among the partners, the dispute is based upon the rights arising from agreement (i.e. partnership deed).

e) A Partnership firm is not required to file its annual accounts for each year unlike a LLP or companies (OPC, pvt ltd).

For more: https://registrationshops.in/partnership-firm/

3.a) Overview of LLP (Limited Liability Partnership) registration

a) Limited Liability Partnership is a corporate structure that contains the features of both partnership firm and company.

b) Limited Liability Partnership is a separate legal entity from its partners and liability of each partner is limited to their contribution.

c) LLP can be formed by any two or more persons, associated for carrying on a lawful business.

d) The rights and duties of partners shall be governed by an agreement between partners.

e) LLP was comes under the Limited Liability Partnership Act (2008).

f) A minimum of two partners will be required for formation of an LLP. There will be not any limit to the maximum number of partners.

3.b) Benefits of LLP Firm registration

a) LLP protects the member’s personal assets from the liabilities of the business

b) LLP has no requirement to get their accounts audited. This is perceived to be a significant compliance benefit. A Limited Liability Partnership is required to get the tax audit done only in the case that: - The contribution of the LLP exceeds Rs. 25 Lakhs or the annual turnover of the LLP exceeds Rs. 40 Lakhs.

c) LLP have to face less compliance burden as they have to submit only two statements i.e. the Annual Return & Statement of Accounts and Solvency.

d) LLP agreements are customized in according to meet the needs of partners concerned

e) The cost of registration of LLP is low as compared to any other company (Public or Private).

For more: https://registrationshops.in/llp-registration/

4.a) Overview of OPC (One Person Company) registration

a) A One Person Company is a company with a single person who can act as director as well as shareholder.

b) It is a new form of business introduced by the Companies Act 2013, thereby enabling Entrepreneur carrying on the business in the sole proprietor can enter into a corporate framework.

c) It must have a minimum of one director; the sole shareholder can himself be the sole Director.

d) The word “One Person Company” or “OPC” must be mention in brackets after the name of the company to distinguish it from other forms of companies.

e) One Person Company cannot be converted into any kind of company unless two years have been expired from the date of incorporation except in case its paid up share capital exceeds 50 Lakhs or its average turnover during the relevant period exceeds 2 Crores.

f) It can be formed with a minimum capital of Rs. 1 lakh.

4.b) Benefits of One Person Company registration

a) Easily Setup and recommend to Growing Start-up’s.

b) Easily raise funds from banks, financial institutions and investors.

c) Easy to go expand your business globally.

d) A One Person Company is considered to be a separate legal entity. It has its own identity and very much recognised as a separate company under the law.

For more: https://registrationshops.in/one-person-company/

5.a) Overview of Private Limited Company registration

a) A private limited company is a type of privately held small business entity. This type of business entity limits owner liability to their shares, limits.

b) Private limited company is incorporated under the Companies Act of 2013, and governed by the Ministry of Corporate Affairs (MCA).

c) A minimum of two directors and a maximum of 15 directors are allowed in a private limited company.

d) A minimum of two shareholders and a maximum of up to 200 shareholders are allowed in a private limited company.

5.b) Benefits of Private Limited Company registration

a) Easily Setup and recommend to Growing Start-up’s.

b) Easily raise funds from banks, financial institutions and investors.

c) Easy to go expand your business globally.

d) Shares of a company limited by shares are transferable by a shareholder to any other person.

e) A private limited company is considered to be a separate legal entity. It has its own identity and very much recognized as a separate company under the law.

For more: https://registrationshops.in/private-limited-company/

6.a) Overview of Public Limited Company registration

a) Public limited company is the most popular corporate entity in India.

b) A public limited company is a type of privately held small business entity. This type of business entity limits owner liability to their shares, limits.

c) Public limited company is incorporated under the Companies Act of 2013, and governed by the Ministry of Corporate Affairs (MCA).

d) To incorporate a public limited company a minimum of three directors and seven shareholders are required over the age of 18 years with atleast one person being an Indian citizen and resident.

e) A minimum of seven shareholders and a maximum of unlimited shareholders are allowed in a public limited company.

f) The shareholders of a company do not participate in the day-to-day activities of a company. The power of decisions is taken at the Board level by the majority rule.

6.b) Benefits of Public Limited Company registration

a) Easily Setup and recommend to Growing Start-up’s.

b) Easily raise funds from banks, financial institutions and investors.

c) Easy to go expand your business globally.

d) Shares of a company limited by shares are transferable by a shareholder to any other person.

e) A public limited company is considered to be a separate legal entity. It has its own identity and very much recognized as a separate company under the law.

f) Shareholder enjoys limited liability to the extent of capital invested. Shareholder’s personal assets protected in the event of the company’s insolvency.

g) Public limited companies are listed their company on the stock exchange where it’s share/stocks are traded publicly.

For more: https://registrationshops.in/public-limited-company/

7) Our company bio

Registrationshops Business Consultancy Services was India’s leading online legal services provider located in Madurai. We are dedicating to helping people easily start their company and grow their business, at an affordable cost. We can help to people for company formation, company registration, Tax services, Website & Logo Designing and other online registration services.

url: https://registrationshops.in/

Contact Us:

Company Name: Registrationshops Business Consultancy Services

Contact Person: Registrationshops Business Consultancy Services

Call or WhatsApp: +91 8667660828

Phone: +91 6379031710

Email: contact@registrationshops.in

City: Madurai

State: Tamil Nadu 625001

Country: India

Website: https://registrationshops.in/