If you’ve made the decision to enter your mum, dad or loved one into aged care, there are some important decisions, as well as some legal considerations when entering aged care to make when it comes to planning for the future.

One of those, is who will have the authority to make decisions on their behalf?

The law looks at decisions in two different categories: financial and lifestyle.

Financial decisions cover things like: dealing with bank accounts, bills, shares or property.

Lifestyle decisions include things like: where you should live and the medical treatment you might receive.

While your loved one could be capable of making their own decisions right now, there may come a time where this is no longer the case. Having the right structures in place early on gives your loved one the opportunity to control that decision.

At Care360 we often meet families who are faced with a bunch of care decisions that need to be made in a very short timeframe, several of which are legal considerations. We have compiled this list of the most important legal considerations when entering aged care.

Power of Attorney

If your loved one decides to appoint a financial decision-maker, they can complete a legal form called a Power of Attorney. They can decide what powers they give to the appointed person when it comes to managing their property and financial affairs.

There are two different types of Power of Attorney: a general Power of Attorney and enduring Power of Attorney.

A general Power of Attorney is for a specific period of time, for example, this could be useful if you are going into hospital and want someone to manage your affairs for a short period of time. Or it could be for a specific purpose, like to sell your property for you.

An enduring Power of Attorney is where someone is given the power to make decisions when they can no longer do so. There is the option to choose when you want this to begin, which could be at the point where capacity is lost to make decisions.

Without a Power of Attorney, the resident’s family may have difficulty accessing bank accounts to pay bills or to manage property which may be required to fund aged care. It also means if there were to be an argument between family members, there wouldn’t be anyone who can resolve disputes and make decisions.

Guardianship

Another option could be to appoint an enduring guardian who makes lifestyle decisions for the resident. This is done by completing an ‘appointment of enduring guardian’ form, and the resident can decide what powers they give to their enduring guardian. The enduring guardian is also the person who can give consent to doctors for any proposed treatments.

At the time of treatment, if the patient is unable to give consent, doctors will ask (in order of priority): the enduring guardian, if one has been appointed, the most recent spouse or de facto partner, an unpaid carer providing support, a relative or friend who has a close relationship with the patient.

If your loved one has not formally appointed someone to manage their affairs, a Guardianship board or tribunal can appoint a guardian on their behalf.

When choosing an enduring guardian, your loved one should be looking for:

- someone who understands their values and wishes

- someone they trust to understand the issues they will need to consider and then be able to make a decision

- willing to accept the responsibility

- over 18 years of age

The rules on guardians are different in every state and territory so you will need to find out the details of Guardianship based on your location.

Administrator

If your loved one has already lost their ability to make reasonable judgements about managing their estate, but there isn’t an enduring Power of Attorney in place, the state government can appoint an administrator who can make financial and legal decisions for them. This does not include personal and lifestyle decisions.

Advance health care directive AKA a living will

Your loved one can record their wishes about the treatment they want and don’t want in the future by creating an advance health care directive, which is also known as a living will.

This will only be used should the patient be unable to give consent to medical treatment but had specific requests in relation to their healthcare. One example could be in the event of accident or illness where they do not consent to life-saving measures.

This is a very specific directive that states the patient’s exact preferences for treatment. It is typically discussed with a doctor and signed, witnessed and advised to the person who will be giving consent on the patient’s behalf.

Will

Moving into aged care can sometimes be quite a fast process, and it’s a good idea for your loved one to have their will up-to-date before entering an aged care home.

A will states what will happen to an estate and asset in the event of death which forms part, but not all, of an estate plan and covers things like:

- How assets will be shared?

- Who will look after young children?

- Trusts

- Money to go to charities and,

- Funeral plans

Summary

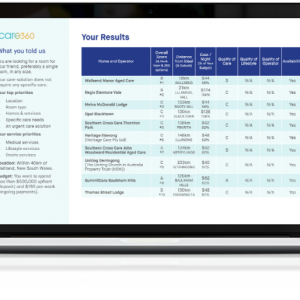

Care360 understands there are many considerations when transitioning to aged care, not just legal. Care360’s Aged Care Navigation service helps minimise the stress involved in the transition to aged care. You will be assigned your own Aged Care Consultant who will use their independent, specialist expertise in aged care to support you through the process of finding aged care, funding aged care and following your loved one’s progress once they enter care.

If you would like the support of a Care360 Aged Care Consultant to walk you through all the steps required to transition to aged care, then we are here to help. Get more information here.